Sign up for our newsletter

Sign up today to stay in the loop about the hottest deals, coolest new products, and exclusive sales.

Wahnapitae, ON P0M 3C0

Phone: 705-694-0065

Fax: 705-694-1594

Toll Free: 1-877-224-2323

Email: info@ibeadcanada.com

Mon-Sat: 10am - 6pm

Sun: 11am-5pm

Mon-Sat: 10am - 6pm

Sun: 11pm-5pm

Free Shipping on Most Orders Over $150* – Learn More >

Beaded Rosettes

Beaded Rosettes

Bells

Bells

Cabochons

Cabochons

Dolls & Acc.

Dolls & Acc.

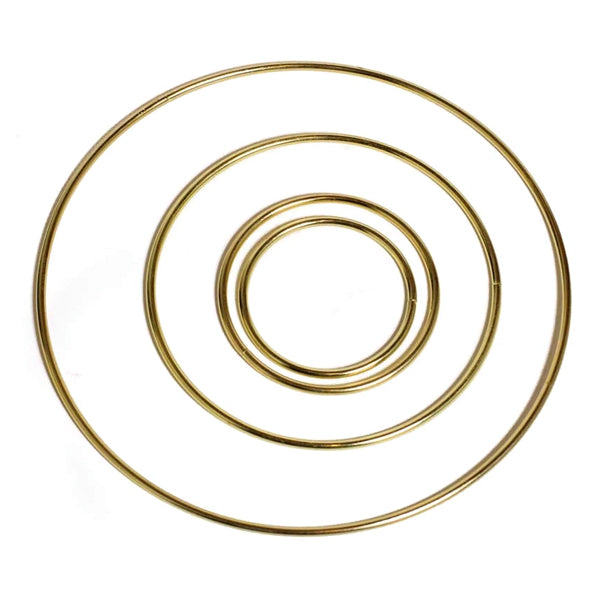

Dream Catcher Rings

Dream Catcher Rings

Drum Making

Drum Making

Flat Back Stones

Flat Back Stones

Jingle Cones

Jingle Cones

Mirrors

Mirrors

Pipe Stems

Pipe Stems

Rhinestone Banding

Rhinestone Banding

Sequins

Sequins

Sew On Stones

Sew On Stones

Beading Foundation

Beading Foundation

Crepe Soles

Crepe Soles

Elastic Cord

Elastic Cord

Fabric

Fabric

Fringe

Fringe

Ribbon

Ribbon

Trim

Trim

Bails

Bails

Bolo Tie Acc.

Bolo Tie Acc.

Bookmarks

Bookmarks

Brooch & Bar Pins

Brooch & Bar Pins

Buckles

Buckles

Buttons

Buttons

Caps & Cones

Caps & Cones

Chain Extenders

Chain Extenders

Clasps

Clasps

Crimps & Ends

Crimps & Ends

Conchos

Conchos

Connectors

Connectors

Earring Components

Earring Components

Eyelets & Snaps

Eyelets & Snaps

Findings Sets

Findings Sets

Garment Studs

Garment Studs

Hair Accessories

Hair Accessories

Head & Eye Pins

Head & Eye Pins

Jewelry Parts

Jewelry Parts

Jump & Split Rings

Jump & Split Rings

Key Chain Parts

Key Chain Parts

Mobile Phone Acc.

Mobile Phone Acc.

Safety Pins

Safety Pins

Wire Guards

Wire Guards

Feathers

Feathers

Furs & Animal Parts

Furs & Animal Parts

Leather & Rawhide

Leather & Rawhide

Cord

Cord

Chain

Chain

Leather & Suede Lace

Leather & Suede Lace

Sinew

Sinew

Thread

Thread

Jewelry Wire

Jewelry Wire

Memory Wire

Memory Wire

Shaping Wire

Shaping Wire

Bead & Craft Kits

Bead & Craft Kits

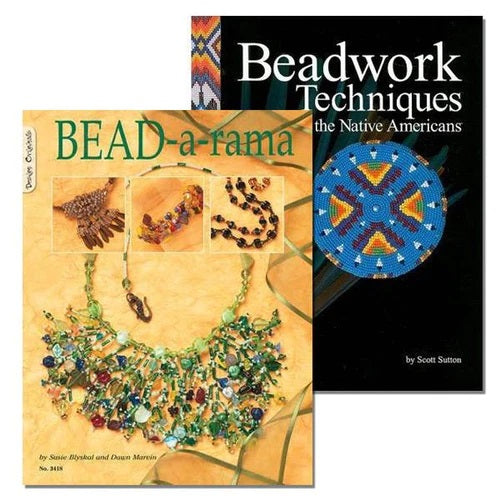

Books

Books

Patterns

Patterns

Displays

Displays

Gift Bags

Gift Bags

Gift Boxes

Gift Boxes

Jewelry Cards

Jewelry Cards

Organizers

Organizers

Tags, Labels & Stickers

Tags, Labels & Stickers

Zip Lock Bags

Zip Lock Bags

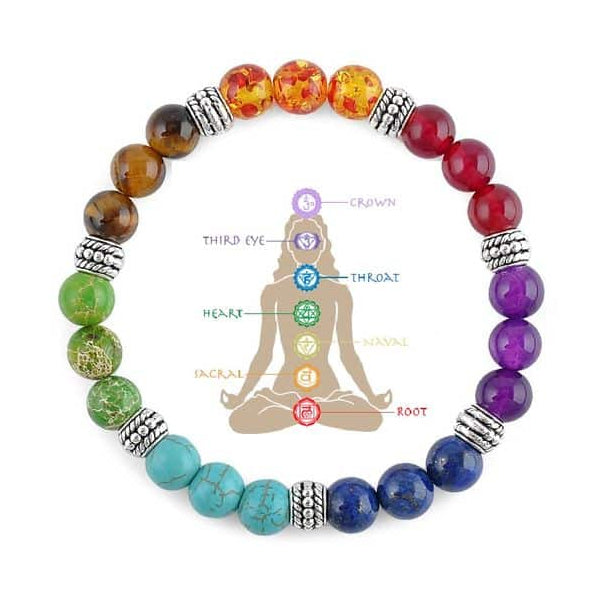

Chakra

Chakra

Healing Stones

Healing Stones

Incense & Holders

Incense & Holders

Mala Beads & Acc.

Mala Beads & Acc.

Oils & Burners

Oils & Burners

Rocks & Minerals

Rocks & Minerals

Smudging

Smudging

Last updated: November 29, 2024

i-Bead Inc. offers Indian Status Tax Exemption for eligible customers making online purchases. To qualify for GST/HST relief, there are specific conditions set by the Canada Revenue Agency (CRA) that must be met. Please review the following guidelines carefully to ensure you can use your Indian Status Tax Exemption card for online orders.

According to the CRA, when making sales over the telephone, internet, or other electronic means, vendors must maintain proper documentation to support that the sale qualifies for GST/HST relief. Since status card holders cannot present their original status card or Tax Exemption Card (TCRD) online, the CRA has outlined the following process:

Documentation Requirements: You may provide a photocopy of your status card or TCRD (for Indians) or certification (for Indian bands or band-empowered entities) before the transaction via mail, email, or fax to validate the tax exemption.

Eligibility Requirements for full GST/HST Tax Relief: For online purchases to qualify for full tax relief, the following conditions must be met:

Eligibility Requirements for Ontario Residents GST/HST Tax Relief: For online purchases to qualify for the 8% rebate of the provincial portion of the HST, the following conditions must be met:

If you meet the eligibility criteria outlined by the CRA, please follow these steps:

Fill out the Status Card Submission Form: Before you place an order, you must complete the Status Card Submission Form below. This is required for online orders as the rules differ from in-store purchases.

Provide Your Information: You will need to provide the following details:

Account Verification: Once we receive your submission, i-Bead Inc. will verify your information and create a special customer profile for you that is fully tax-exempt.

Online Profile Adjustment: If you already have an online account with us, we will adjust your profile to reflect tax exemption. If you don’t have an account, you will receive an invitation to set up a new profile via email.

Wait for Confirmation: You must wait for confirmation from i-Bead Inc. before placing your order. Unfortunately, we can no longer alter or change the taxes on orders once they have been placed online.

Penalties for Misrepresentation: The CRA enforces penalties, interest, and fines for misrepresenting eligibility for GST/HST exemptions. Please ensure that all information provided is accurate.

CRA Penalties, Interest, and Fines Information

Acceptable Status Cards: For a list of acceptable Status Cards, please visit: Is your status card valid.

i-Bead Inc. and the Canada Revenue Agency (CRA) recognize that many First Nations people in Canada prefer not to describe themselves as "Indians." However, the term "Indians" is used in this context because it has a legal meaning under the Indian Act.

Sign up today to stay in the loop about the hottest deals, coolest new products, and exclusive sales.

Thanks for subscribing!

This email has been registered!

Last updated: September 11, 2025

Summary of i-Bead Inc.'s Terms of Service:

Product Descriptions: i-Bead Inc. strives for accurate product information, but errors may occur. Product availability and specifications, like size, are subject to change.

Product Images: Images are for representation purposes; actual products may vary in appearance due to display settings or manufacturing differences.

Copyright & Intellectual Property: All content on the Website is owned by i-Bead Inc. or its licensors. Users are granted a limited, non-commercial license to view and print content for personal use but cannot reproduce or distribute it without permission.

Trademarks: The i-Bead name and logo are trademarks of i-Bead Inc. Unauthorized use of trademarks is prohibited.

Use of the Website: Users must comply with laws and the Terms. Account creation may be required for certain services. Users are responsible for account security and cannot engage in harmful behavior or unauthorized access.

Pricing & Availability: Prices are listed in Canadian Dollars (CAD) and are subject to change. Additional charges for taxes, shipping, and duties may apply. Out-of-stock products may be removed or delayed.

Limitation of Liability: i-Bead Inc. is not liable for any indirect damages, and the website is provided "as is" without warranties.

Privacy & Data Protection: The use of personal data is governed by the company’s Privacy Policy, which users should review.

Indemnification: Users agree to defend and hold i-Bead Inc. harmless from any legal issues arising from their use of the site or violation of the Terms.

Modifications: i-Bead Inc. can update these Terms at any time. Changes will be effective upon posting.

Governing Law: The Terms are governed by the laws of Ontario, Canada, and any disputes will be resolved in Ontario courts.

Contact Information: For questions, users can contact i-Bead Inc. at their address or via email or phone.

Summary of i-Bead Inc.'s Refund Policy:

In-Store Purchases: Items can be returned within 30 days with the original receipt for an exchange, store credit, or refund. Must be unopened and in original condition.

Online Purchases: Returns allowed within 30 days of receiving your order. Prior authorization required. Items must be unopened and in original condition.

Non-Returnable Items: Sale items, opened packages, broken strands, cut items (e.g., leather, cord), books, and special orders cannot be returned.

Restocking Fee: Returns after 30 days incur a 20% restocking fee. Clearance/discontinued items cannot be returned after 30 days.

Damaged/Defective Items: Contact customer service within 48 hours. Return shipping will be covered, and you can request a refund or replacement.

Return Instructions: Include the reason for the return, order details, and use a traceable shipping carrier. Returns must be prepaid, and customs fees are not covered.

Refund Process: Refunds will be issued after inspection, minus shipping costs, and may take 1-2 weeks to process.

For returns, the items must be in their original, unopened condition.

Summary of i-Bead Inc.'s Shipping Policy:

Shipping Methods: i-Bead uses Purolator, UPS, Canpar, and FedEx for Ground and Express shipping.

Shipping Times: Orders placed by 12:00 PM EST ship the same day; orders placed after that time ship the next business day. V.I.Bead Members get same-day shipping regardless of order volume.

Shipping Locations: We ship within Canada and to select international destinations (excluding the United States). P.O. Boxes are not eligible.

Shipping Discounts:

Tracking & Insurance: All orders include tracking. Insurance is included for orders under $100; additional coverage is available for $3 per $100.

Damage or Loss: Contact customer service within 48 hours if your order is damaged or lost during transit. Claims will be processed with the courier.

Theft: i-Bead is not responsible for theft once a package is marked as delivered. Signature confirmation is available for added security.

Delays: Delivery may be delayed due to factors like weather, rural locations, or peak seasons.

Summary of i-Bead Inc.'s Sales Tax Policy:

Canadian Residents: Sales tax is applied based on the province:

First Nations: Eligible customers may receive tax relief with the Indian Status Tax Exemption Card.

U.S. & International Orders: U.S.: Not applicable—shipping is paused. International (non-U.S.): No Canadian sales tax or VAT is charged by i-Bead; destination duties/taxes may apply.

In short, Canadian customers are taxed based on their province; U.S. orders are not available; international customers may incur destination duties/taxes.

Summary of i-Bead Inc.'s Native Status Card Policy:

Tax Exemption Eligibility: Status Card holders can qualify for GST/HST relief if:

Ontario Residents: Eligible for an 8% HST rebate on orders shipped within Ontario.

How to Apply:

Important: Misrepresentation of eligibility can result in penalties from the CRA.

In short, eligible Status Card holders can receive tax relief by following the proper procedure and submitting required documentation.

Summary of i-Bead Inc.'s Privacy Policy:

i-Bead Inc.'s Privacy Policy outlines how they collect, use, and disclose personal information. They gather data directly from users (e.g., contact details, order info, payment info) and through tracking technologies (e.g., cookies). This data is used for order processing, marketing, security, and customer support. The company may share data with third-party vendors and partners for service fulfillment, marketing, and legal compliance. Users can access, correct, or delete their data, and opt-out of marketing communications. The policy also covers data security, retention, and international transfers.

By completing the checkout process, you (the customer) acknowledge that you have read, understood, and agreed to the Terms and Conditions outlined by i-Bead Inc. Furthermore, you agree that i-Bead Inc. shall not be held liable for any delays in shipping caused by factors beyond its control, including, but not limited to, disruptions due to COVID-19, adverse weather conditions, holiday seasons, natural disasters (Acts of God), strikes, or lock-outs or any other unforeseeable events. In addition, in the event that a parcel is damaged or lost during transit, and you have not obtained additional insurance coverage, you expressly agree that i-Bead Inc. shall not be held responsible or accountable for any resultant loss, damage, or delay.

Wahnapitae, ON P0M 3C0

Phone: 705-694-0065

Fax: 705-694-1594

Toll Free: 1-877-224-2323

Email: info@ibeadcanada.com

Mon-Sat: 10am - 6pm

Sun: 11am-5pm

Mon-Sat: 10am - 6pm

Sun: 11pm-5pm